Written by Yanis Kharchafi

Written by Yanis KharchafiBuybacks in the Swiss 3rd pillar A from 2025: How does it work?

Introduction

Starting January 1, 2025, a significant shift will redefine Switzerland’s fiscal landscape: it will become possible to make buybacks in your 3rd pillar A. This new measure, inspired by existing practices in the 2nd pillar, holds promise for interesting tax benefits but also raises concerns about complexity and administrative management.

In this article, we aim to analyze this reform based on the available information, highlight its advantages, and help you avoid potential pitfalls.

The line-up:

A quick reminder: What is the 3rd pillar A?

The 3rd pillar A, also known as private or tied pension provision, represents the private component of Switzerland’s retirement system.

Key advantages

- Tax reduction: Contributions of up to CHF 7,258 as of 2026 are deductible from your taxable income, regardless of the canton you live in.

- Simplicity and flexibility: Available through a bank or insurance, this is an effective solution for preparing for retirement while optimizing your tax situation.

For a comprehensive summary of the 3rd pillar A specifics, check out our detailed articles and dedicated videos.

The reform and its changes starting January 1st, 2025

Starting January 1, 2025, if you haven’t contributed the maximum annual amount to your 3rd pillar A (expected to be CHF 7,258), you’ll be able to make up for it retroactively! That’s right: it will now be possible to catch up on contributions for up to ten years, while still benefiting from a deduction on your taxable income.

Each year, in addition to your regular contribution, you can make up for past shortfalls to reach the maximum cap, as long as you haven’t deducted the full amount previously.

However, there are a few conditions to qualify for this opportunity:

- You must have been eligible to contribute for the year you want to catch up on. In practical terms, this means you must have had income subject to AHV (Swiss social security) that year.

- You must also be eligible in the year of the buyback and have already made the maximum contribution for that year.

The cherry on top? These buybacks, like your annual contributions, will be fully deductible from your taxable income.

To prevent abuse and ensure transparency, rules have been established to keep everything in check. Tax authorities will have the means to verify that everything is in order.

So, starting in 2025, if you’re unable to contribute the maximum to your 3rd pillar A, you’ll create gaps that can be filled later.

Here’s a simple example to clarify:

Imagine in 2025 you contribute CHF 3,258, and in 2026, you put CHF 5,000 into your 3rd pillar. Since the authorized maximum is CHF 7,258 (assuming this remains consistent for those years), you can make up the shortfall until 2035, starting in 2026 for 2025.

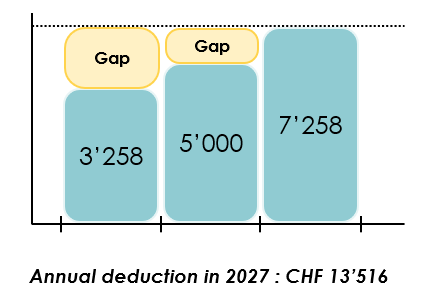

For example, in 2027, you can buy back the gaps for 2025 and 2026:

- For 2025: You make up the CHF 4,000 shortfall.

- For 2026: You add CHF 2,258.

This way, you’ll reach the maximum of CHF 7,258 for both 2025 and 2026 in 2027. In 2027, you’ll have contributed: CHF 7,258 (for the current year, 2027) + CHF 4,000 + CHF 2,258. This means you could theoretically claim a tax deduction of CHF 13,516. Not too bad!

What are the conditions for making buybacks in the 3rd pillar A?

With this new option coming into effect, buybacks in the 3rd pillar A present exciting opportunities to optimize your retirement savings while reducing your taxes. However, like any fiscal novelty, it comes with rules! To ensure everything is in order and avoid unpleasant surprises, here is a clear and straightforward summary of the conditions you must meet before catching up on missed contributions.

Buybacks are time-limited

First and foremost, it’s important to note that buybacks will only be possible starting from 2025. If you didn’t contribute the maximum in 2024, unfortunately, there’s no way to retroactively cover that gap.

In practical terms, you’ll be allowed to make buybacks in your 3rd pillar A for up to 10 years after the year of the shortfall. For instance, if you didn’t contribute the maximum in 2025, you’ll have until 2035 to make up for it and reach the cap for that year.

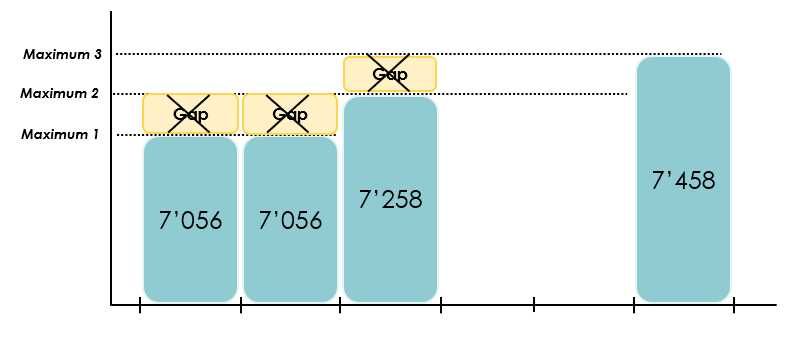

Buybacks are limited to the maximum contribution

As you now know, the maximum amount you can contribute to your 3rd pillar A is capped annually. This cap can vary from year to year, as seen between 2024 (CHF 7,056) and 2025 (CHF 7,258). In practice, this means that buybacks will only be possible if you haven’t already reached the maximum for a given year—you won’t be able to contribute beyond this amount.

If you’ve already contributed the maximum each year and the cap increases in a subsequent year, as it does between 2024 and 2025, this increase won’t grant additional buyback rights. The maximum contribution for the 3rd pillar A is strictly limited to the cap set for each specific year.

No activity, no buybacks

To be eligible to buy back a specific year, you must prove that you had income subject to AHV contributions for the year in question.

For example, if in 2026 you take a sabbatical or are without gainful employment, you will never be able to retroactively buy back this gap.

Maximum contribution must be reached for the current year

Another nuance of this reform is that you cannot make buybacks for your 3rd pillar A if you have not contributed up to the annual cap for the current year. Let me explain: suppose the maximum cap for 2025 and 2026 is CHF 7,258. If in 2025 you didn’t reach the cap and want to make a buyback in 2026 to cover the 2025 shortfall, you will only be allowed to do so if you have already contributed the maximum for 2026—i.e., CHF 7,258 in our example.

No pension benefits received

It’s essential to note that you cannot make buybacks if you have already received retirement benefits from your 3rd pillar A account(s). For instance, if you have partially withdrawn funds from your 3rd pillar, buybacks will no longer be allowed.

Be ready to justify yourself

Any missed contributions you wish to buy back must be justified. You’ll need to prove that you meet all the above conditions, provide all necessary documentation, and validate the buyback with your pension institution.

A true fiscal opportunity or hidden advantages?

At FBKConseils, our mission is to be as transparent as possible with you. While this reform presents some exciting possibilities, it also raises several questions and doubts. Let’s delve into the key concerns:

A fiscal paradox?

Rumors suggest a potential tightening of the tax rules regarding capital withdrawals. While these are unconfirmed for now, their existence could hint at broader fiscal changes. Tightening tax rules on one side while offering more deductions through 3rd pillar A buybacks—are we simply giving with one hand and taking with the other? Time will tell.

Genuine advantages?

A deeper analysis of these buybacks reveals some inconsistencies:

Who is this reform really aimed at?

In theory, anyone who doesn’t contribute the maximum amount.

However, to buy back for previous years, you must have contributed the maximum for the current year.

This means that individuals with lower incomes might still struggle to reach the maximum contribution, unless their earnings increase over time.

Conversely, wealthier households, who typically already contribute the maximum amount to their 3rd pillar A annually, won’t benefit from buyback opportunities since the cap will already have been reached.

So, the real question remains: Who will truly benefit from this reform?

Potentially complex administration

If the answer to the previous question is, “It benefits those who created it and the tax authorities,” that might not entirely be the case either. This reform could create a significant additional workload for pension institutions and tax administrations.

Imagine someone with 3, 4, 5, or even 10 different 3rd pillar accounts. Since the maximum contribution applies to the total across all accounts, the verification process could become incredibly complex.

While this reform opens up new possibilities for optimizing taxes and preparing for retirement, it seems to target a specific demographic. If you plan to take advantage of it, ensure you meet all the conditions and prepare for potentially intricate administrative processes.

How can FBKConseils support your retirement planning?

Retirement planning, along with private taxation and real estate, is central to our expertise. At FBKConseils, we’re here to answer all your questions, perform financial and tax simulations, and provide tailored solutions to optimize your situation.

A free initial consultation

For 2025, FBKConseils will continue to offer all new clients a free 20-minute consultation. This meeting allows us to introduce ourselves and, more importantly, address all your questions about the 3rd pillar and its tax implications.

Tax simulations

We can help you gain a clearer view of your finances and retirement planning by performing simulations with and without the 3rd pillar. If you don’t already have a 3rd pillar account, we can assist with opening one.

Advice on choosing the best 3rd pillar A

We offer our expertise to help you find the 3rd pillar A product that best suits your situation.