Written by Yanis Kharchafi

Written by Yanis KharchafiHow to read your LPP certificate?

“Dear God, what on earth is a coordination amount?”

If you landed on this page, you are probably wondering how to crack the code of your retirement pension certificate.

How much will your pensions be? How can you withdraw to finance your real estate purchase? What percentage of your income is insured in case of a mishap?

There exists a piece of paper on which part of your future is written down. It is illegible. It is frustrating but it is not your fault. I cannot tell you why but insurances just love complicated words.

In this article, we will unscramble together each paragraph of your LPP certificate.

We will shed light on as well as clarify relevant information according to your goals.

The line-up:

What is an LPP certificate?

At the end of every year, your pension fund (chosen by your employer) sends you a paper informing you of your account’s state and the developments in your coverage. This piece of paper is called the LPP certificate or occupation pension certificate.

And what is the LPP?

It is your occupational pension scheme, governed by the Occupational Pensions Act.

As soon as a business owner hires employees, he must join a pension fund to make sure they contribute to the second pillar in view of their retirement.

In other words, if you are an employee, part of your income will be dedicated to your second pillar. Part of the contributions are paid by the employer. The other part is taken from your salary.

The amount is transferred to a pension fund’s account, which also serves as a disability insurance… or death insurance.

The minimal requirements are determined by the law and evolve over time. The employer can offer social benefits by paying a higher percentage that you, for example.

First part: personal information

The certificate is personally addressed to you. This is why you will find your contact information at the top of the document.

Aside from your surname, name and address, you will also find your policy number, OASI number and affiliation date to the relevant pension fund.

So far so good.

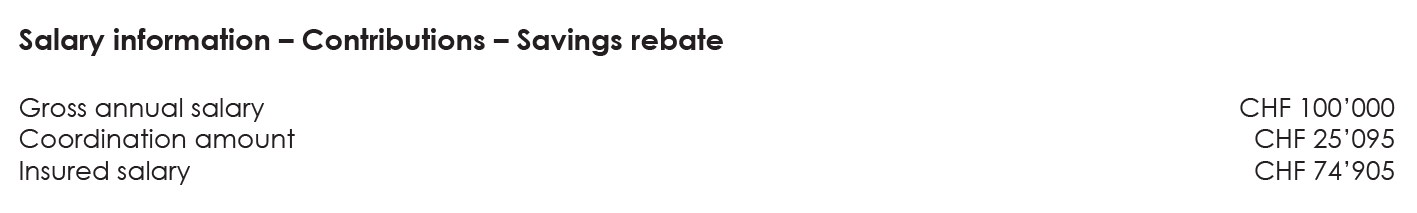

Second part: income information – contributions – savings rebate

After a reminder of your gross annual salary – which you are probably aware of – appears the first mystery of your certificate.

What is a coordination amount?

It is the amount that is not insured by the second pillar. Why? Because it is already insured by the first pillar, the OASI.

At the legislation level, the pension fund can deduct up to 25,095 CHF per year (in 2023). Once the new law on occupational pension provision comes into force, the coordination deduction will no longer be a fixed amount but rather a percentage of AVS salary. If your gross salary is CHF 60,000, the coordination deduction will be CHF 60,000 x 20% = CHF 12,000 and your insured salary will be CHF 48,000.

The amount is specified on your certificate because your employer can reduce, or even fully compensate this deduction.

For example, if I make 100,000 CHF gross and my pension fund deducts the statutory maximum, I am ensured up to 74,905 CHF.

If he covers 10,000 CHF extra, my gross income is insured up to 84,905 CHF. And so on…

Your gross salary – the coordination amount + the potential contribution of your employer = the salary insured by your occupational benefit.

Third part: additional savings plan

Expressed in percentages, the saving contributions states which part of your income is set aside for your retirement.

In my case, you can see that the employer’s part – FBK Conseils – is higher than that of the employee – me, Noé.

The risks contribution and special contribution concerns the part of the income meant to cover risks of life such as disability and death.

Finally, the total contribution represents the combination of both contributions.

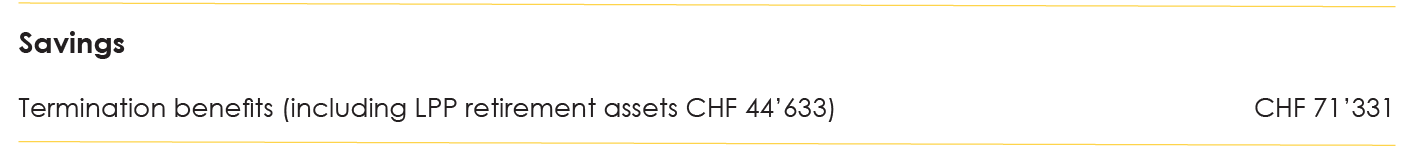

Fourth part: Savings

The total amount of your savings is stated on the right of the line vested benefits.

The LPP retirement assets is the amount, determined by the law, that you saved. The total amount includes the retirements assets, the supplementary insurance and the potential savings rebate (if your second pillar is invested, for instance).

You can see that the supplementary can add up to a significant amount. The social advantages offered by an employer are not to be taken lightly.

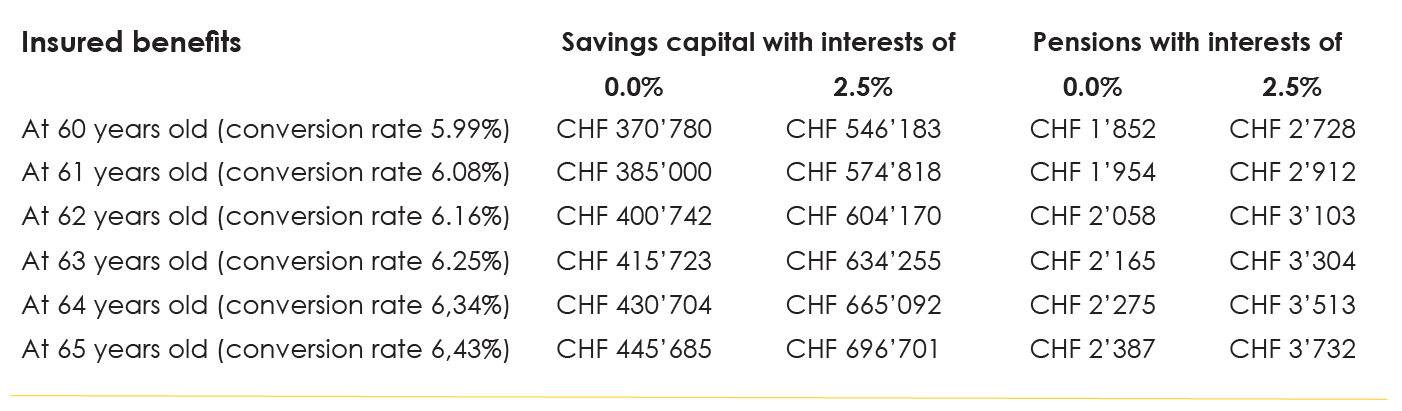

Fifth part: Insured Benefits

In this section, you can see the saved assets and the pensions you will get when you retire (prematurely or not). First without interests, then whit a 2.5% hypothetical interest.

If I retire at the age of 60, I will get 2,728 CHF per month i.e. a single capital of CHF 546,183, compared with 3,732 CHF per month or CHF 696,701 in one go, if I retire at 65 years old, as provided by law.

The difference is significant, right? This is for a simple reason. Between 55 and 65 years old it the time where we contribute the most to our retirement pension.

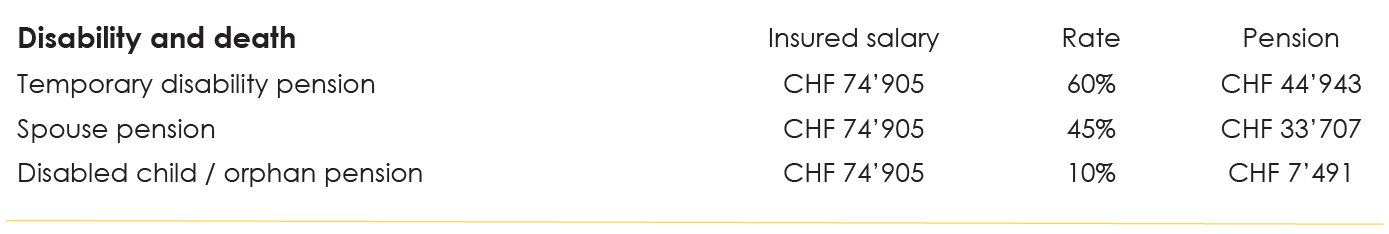

Sixth part: disability and death

The second pillar is not limited to mere savings paid as pensions when you retire. Neither can it be described as an amount you can withdraw when you want to buy your first house.

The second pillar is more than that. It is also an insurance against life’s risks. o

Temporary disability pension:

It compensates for an eventual incapacity to work following an illness. And in case of an accident? The AIA will be responsible.

Spouse pension:

Is a pension paid to your spouse in case of death. If the time of Noé, myself, has come before Zoé’s time, my wife, Zoé will get 45% of my last insured salary. That is 33,707 CHF per year, or 2,808 CHF per month.

Orphan pension:

It is an annual sum paid to orphan children, most often to minors or students until 25 years old. In my case, it amounts to 10% of my last salary. If myself, Noé, and my wife Zoé, passed away, our children, Lea and Leo would get 7,491 CHF per year, or 624.25 CHF per month.

Seventh part: complementary information

Finally, this last section details how many parts you can repurchase this year.

But also the total available amount, should you withdraw your second pillarbefore you retire, for instance to purchase a home by withdrawing it thanks to the homeownership promotion scheme (EPL).

In conclusion: no providence without clairvoyance.

We have seen how to interpret your LPP certificate. You now know how much you may withdraw, what part of your income is insured by your second pillar and your pensions’ evolution.

Please note: the law on occupational pension provision is about to change. On 17 March 2023, Parliament adopted its new reform, which will significantly overhaul the rules that will still apply at the end of 2023.